The Which Type Of Bankruptcy Should You File Ideas

The Which Type Of Bankruptcy Should You File Ideas

Blog Article

A Biased View of Bankruptcy Law Firm Tulsa Ok

Table of ContentsFacts About Which Type Of Bankruptcy Should You File RevealedNot known Incorrect Statements About Bankruptcy Attorney Near Me Tulsa The Experienced Bankruptcy Lawyer Tulsa IdeasA Biased View of Which Type Of Bankruptcy Should You FileWhat Does Tulsa Ok Bankruptcy Attorney Do?Which Type Of Bankruptcy Should You File Fundamentals Explained

Individuals need to make use of Chapter 11 when their financial debts go beyond Phase 13 debt restrictions. bankruptcy lawyer Tulsa. Chapter 12 insolvency is designed for farmers and fishermen. Chapter 12 payment strategies can be extra adaptable in Phase 13.The methods test considers your average regular monthly earnings for the 6 months preceding your filing day and compares it versus the average earnings for a similar household in your state. If your revenue is below the state mean, you instantly pass and do not need to complete the whole type.

If you are wed, you can submit for personal bankruptcy jointly with your spouse or individually.

Filing personal bankruptcy can help a person by discarding financial obligation or making a strategy to pay off financial debts. An insolvency instance usually begins when the borrower submits an application with the personal bankruptcy court. An application might be submitted by a private, by spouses with each other, or by a firm or various other entity. All insolvency instances are managed in federal courts under policies described in the U.S

A Biased View of Tulsa Ok Bankruptcy Attorney

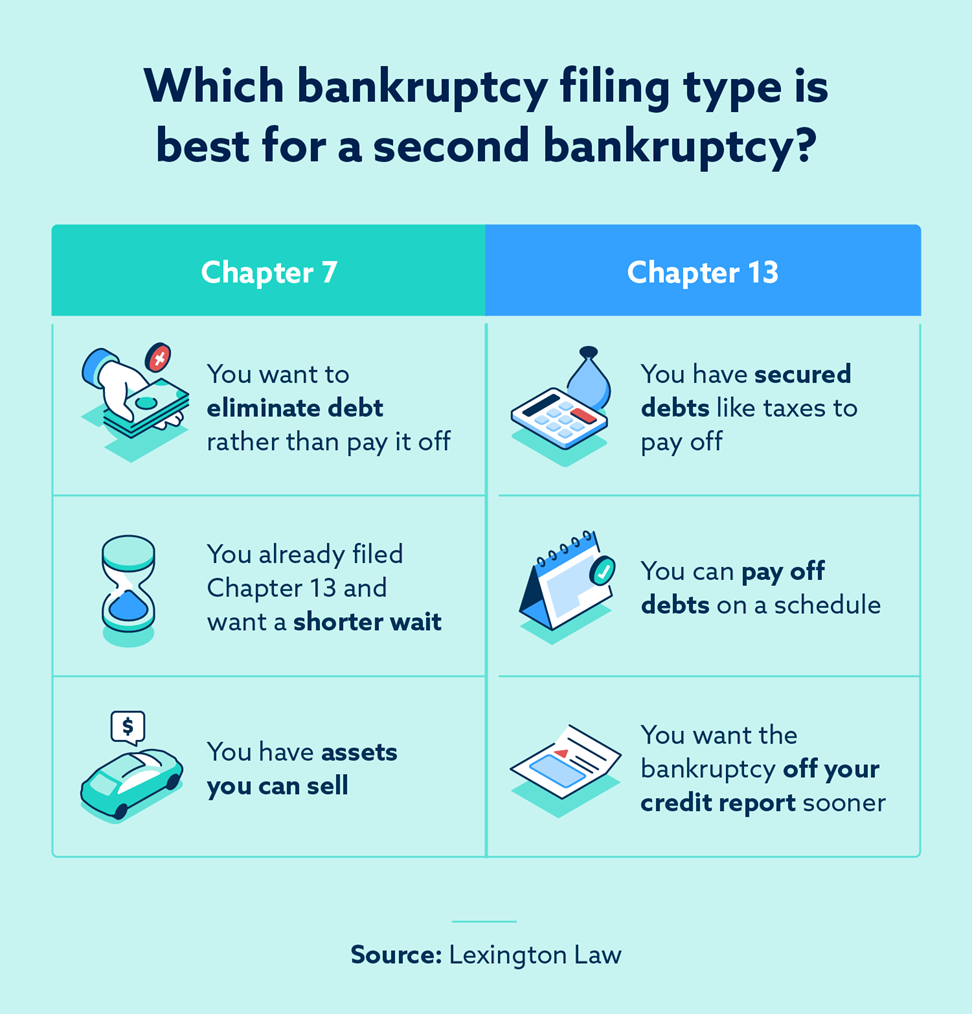

There are different kinds of insolvencies, which are generally described by their chapter in the united state Bankruptcy Code. People may file Phase 7 or Phase 13 bankruptcy, depending on the specifics of their situation. Municipalitiescities, communities, towns, straining areas, municipal utilities, and institution areas may submit under Chapter 9 to restructure.

:max_bytes(150000):strip_icc()/when-declare-bankruptcy.asp_final-dee86ed091424fbead478b44f98860b2.png) If you are facing economic challenges in your personal life or in your service, possibilities are the principle of declaring insolvency has actually crossed your mind. If it has, it additionally makes sense that you have a great deal of insolvency concerns that require responses. Lots of individuals really can not respond to the concern "what is bankruptcy" in anything other than basic terms.

If you are facing economic challenges in your personal life or in your service, possibilities are the principle of declaring insolvency has actually crossed your mind. If it has, it additionally makes sense that you have a great deal of insolvency concerns that require responses. Lots of individuals really can not respond to the concern "what is bankruptcy" in anything other than basic terms.Many individuals do not recognize that there are several kinds of bankruptcy, such as Phase 7, Chapter 11 and Chapter 13. Each has its benefits and obstacles, so understanding which is the finest option for your present scenario along with your future recuperation can make all the difference in your life.

Unknown Facts About Chapter 7 - Bankruptcy Basics

Chapter 7 is labelled the liquidation bankruptcy chapter. In a chapter 7 personal bankruptcy you can remove, clean out or discharge most types of debt.

Many Phase 7 filers do not have a lot in the method of assets. Others have homes that do not have much equity or are in major requirement of repair.

The quantity paid and the duration of the strategy depends on the borrower's property, typical earnings and expenditures. Creditors are not allowed to go after or preserve any collection tasks or legal actions throughout the case. If successful, these lenders will be erased or released. A Chapter over here 13 insolvency is really effective because it gives a device for debtors to prevent foreclosures and constable sales and stop foreclosures and energy shutoffs while capturing up on their protected financial debt.

The 9-Minute Rule for Bankruptcy Attorney Tulsa

A Chapter 13 situation may be beneficial in that the borrower is allowed to obtain captured up on home loans or vehicle loan without the risk of foreclosure or repossession and is permitted to keep both exempt and nonexempt building. The debtor's strategy is a paper laying out to the insolvency court how the borrower suggests to pay existing costs while settling all the old financial obligation equilibriums.

It gives the borrower the chance to either offer the home or end up being caught up on home loan payments that have fallen back. An individual submitting a Chapter 13 can propose a 60-month strategy to treat or become present on home mortgage settlements. For example, if you dropped behind on $60,000 worth of mortgage settlements, you can suggest a strategy of $1,000 a month for 60 months to bring those home mortgage settlements existing.

It gives the borrower the chance to either offer the home or end up being caught up on home loan payments that have fallen back. An individual submitting a Chapter 13 can propose a 60-month strategy to treat or become present on home mortgage settlements. For example, if you dropped behind on $60,000 worth of mortgage settlements, you can suggest a strategy of $1,000 a month for 60 months to bring those home mortgage settlements existing.3 Simple Techniques For Tulsa Ok Bankruptcy Attorney

In some cases it is better to stay clear of personal bankruptcy and resolve with creditors out of court. New Jersey also has an alternative to bankruptcy for companies called an Assignment for the Advantage of Creditors and our law practice will review this alternative if it fits as a possible method for your company.

We have actually produced a tool that aids Tulsa bankruptcy attorney you select what chapter your file is probably to be filed under. Go here to use ScuraSmart and discover out a feasible service for your debt. Many people do not understand that there are a number of sorts of personal bankruptcy, such as Phase 7, Chapter 11 and Chapter 13.

Right here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we handle all types of bankruptcy cases, so we have the ability to address your insolvency inquiries and help you make the most effective choice for your instance. Here is a short take a look at the financial obligation alleviation options readily available:.

The smart Trick of Tulsa Ok Bankruptcy Specialist That Nobody is Talking About

You can only declare personal bankruptcy Prior to declaring for Chapter 7, a minimum of among these must be true: You have a great deal of financial obligation income and/or possessions a financial institution could take. You shed your chauffeur license after being in an accident while without insurance. You need your license back (bankruptcy attorney Tulsa). You have a great deal of financial obligation near to the homestead exception amount of in your house.

The homestead exception quantity is the greater of (a) $125,000; or (b) the county median list price of a single-family home in the preceding fiscal year. is the amount of cash you would certainly keep after you sold your home and repaid the home loan and other liens. You can locate the.

Report this page